Can I Get Help with Costs?

You may be able to get help if you cannot afford Medicare. You may qualify if you have limited income and resources. Certain programs can help pay for your premiums and out-of-pocket costs, such as deductibles and coinsurance.

How do I get help with Part A & B costs?

If you have limited income and assets, you may qualify for help paying for your Medicare Part B premium and other Medicare costs. Medicare and your state Medicaid program work together to provide you with this help, called the Medicare Savings Programs.

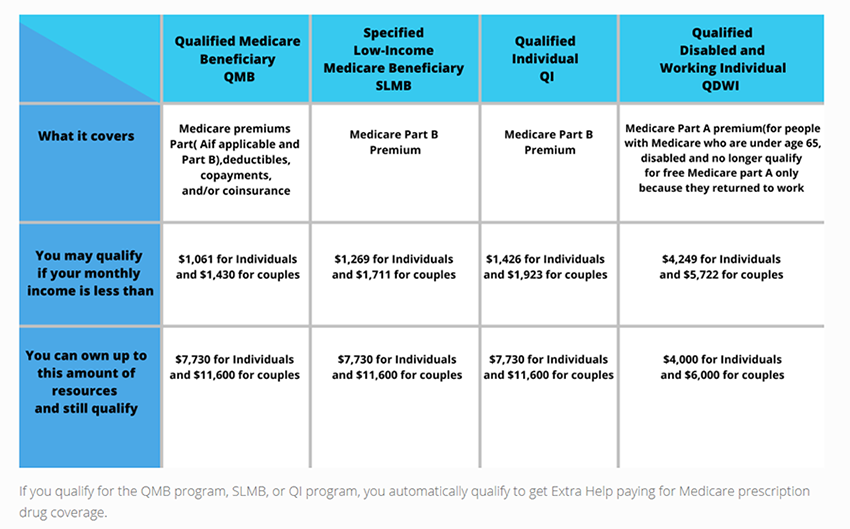

There are four different Medicare Savings Programs. Each program has a different income and resource eligibility limit. Even if you do not qualify for Medicaid, you may qualify for one of these programs to help you cover your Medicare costs.

What are the four Medicare Savings Programs?

The programs are listed below, along with what each program pays for and the income and resource level limits you must meet to qualify.

These amounts offer general guidelines for the Medicare Savings Programs. Some states may have even higher income or resource limits for these programs or they may eliminate resource limits entirely.

How do I get help with Part D costs?

You may be able to get help paying your Medicare drug costs with a program called Extra Help. Also called the Part D low-income subsidy or LIS, Extra Help is a Federal program that helps people with limited income and resources pay for their Part D premiums and drug costs.

Most people who qualify for Extra Help will pay:

- No premiums,

- No deductibles, and

- No more than $7.40 in 2016 for each drug their plan covers.

The amount of Extra Help you get depends on your income and resources. If you qualify for Extra Help, you can join a Medicare Part D plan at any time and will not have to pay a penalty, even if you enroll late.

Do I qualify for Extra Help with costs?

There are different levels of Extra Help available, depending on your income and assets. People with a lower income and fewer assets get more help with their Medicare drug plan costs.

The resource amount includes $1,500 in savings that you can use as a burial fund. Couples can have $3,000 for the burial savings.

You may not qualify for Extra Help with costs if your income or assets are over these limits. Remember you can apply for help even if you are slightly over the limit you need to qualify.

What if I don’t qualify for Medicare Savings Programs or Extra Help?

There are other programs to help you save money on prescriptions. Some states have State Pharmaceutical Assistance Programs (SPAPs). Some drug manufacturers offer discounts on their brand name drugs through Patient Assistance Programs (PAPs).

You still may be able to save money on your Medicare costs by comparing plans and shopping around to find the best coverage for your personal situation.

What if I fall within the coverage gap?

Your total drug costs include what you and the plan pay for your prescriptions. If these are greater than $3,310 in 2016, you will probably hit the coverage gap, also called the doughnut hole. During this period, you will pay a discounted percentage of your drug costs.

If you qualify for Extra Help with costs, you will not have a coverage gap. You will continue to pay reduced or no copays or coinsurance for each prescription. Depending on how much income you have, your copays or coinsurance may get even lower when your total drug costs (what you and your plan pay for your drugs) reach $7,062.50.

You can choose from many plans with different costs. In 2016, you will find plans with high and low monthly premiums, deductibles ranging from $0 to $360 and varied copay and coinsurance amounts.

How else can I lower my drug costs?

Some ideas to lower drug costs are below, which may help if you have a limited income but do not qualify for Extra Help at this time.

- If your state has a State Pharmaceutical Assistance Program (SPAP), consider signing up for it.

- Apply for help from a certified charity like a copay foundation, if there is one for any of your medicines.

- If you’re taking brand name drugs, talk with your doctor about switching to generic drugs. Generic drugs usually cost less, and some plans may cover your generic drugs if you reach the coverage gap. Or ask your doctor about switching to a lower-cost brand name drug that treats your condition.

- Apply for help from a Patient Assistance Program (PAP) that serves people in Medicare Part D plans. If you use a Patient Assistance Program, you must submit your out-of -pocket costs to Medicare yourself, or they will not count towards your total drug costs. Check with your Part D plan to see how you should submit your out-of-pocket costs.

- See if your doctor can give you free samples of any of the medicines you take.

- Contact your county public health department to see if they have a free medicine program.