Marsh Assurance Medicare Enrollment Tool

Click on our logo for more information on Medicare Advantage. Give us a call first and we will be happy to walk you through the process.

Medicare Advantage (MA, PFFS, or MAPD)

These are private Insurance groups that you can choose to manage your original Medicare benefit. Each carrier receives a government subsidy, 1 to 5 stars, from their prior year's service rating. Based on their current rating, the plan may have gained, maintained, or lost government subsidy. Due to these constant service rating fluxuations, we provide assurance for you when selecting product from year to year. Again, there is never, ever any cost for our continued educational guidance and assistance.

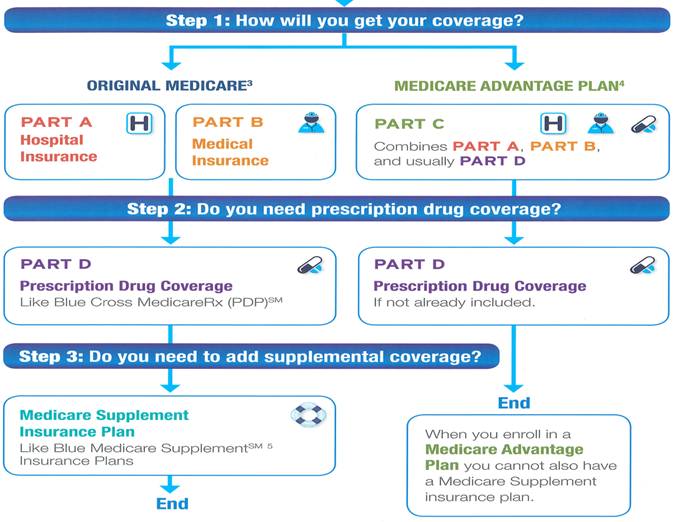

Medicare Advantage plans are private health plans that have contracts with Medicare. When you join one, you get your Medicare-covered healthcare services through the private plan.

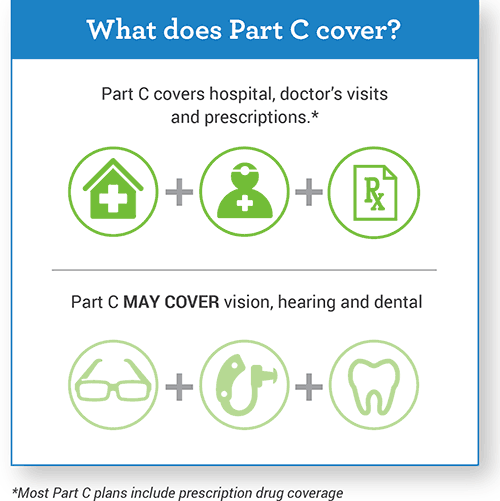

Medicare Advantage plans must cover all the same things as Medicare Part A and B. They also may cover services that Original Medicare does not pay for. Examples are eye exams, a pair of eyeglasses each year or a hearing exam. They may charge different amounts than you would pay through Original Medicare.

Medicare Advantage plans may also cover prescription drugs. If they do, you cannot buy a separate Medicare prescription drug plan.

With Medicare Advantage plans, you generally must use certain providers. These are doctors, hospitals, drug stores and other healthcare providers that the plans have contracts with. These are called in-network providers. If you use providers outside your plan’s network, it may cost you more money. It also may mean you get no Medicare coverage at all for that service.

You must have Medicare Parts A and B to join a Medicare Advantage plan. You pay your usual Part B premium plus any additional premium that the plan may charge.

What are the different types of Medicare Advantage plans?

Medicare Advantage plans come in a variety of types. Learn more about the options you’ll have if you decide to compare Part C Plans.

These are PPOs or HMOs that only admit people with Medicare who:

- Have certain serious chronic medical conditions, or

- People who have Medicaid and Medicare, or

- People who live:

- In certain nursing homes or

- At home but have high care needs and could qualify for a nursing home.

Can I join a SNP?

You can join a SNP if you have Medicare Parts A and B, live in the SNP service area and meet the plan’s eligibility requirements. See the eligibility requirements for SNPs on Medicare.gov.

Are SNPs available everywhere?

Not necessarily. Each year, different types of Medicare SNPs may be available in different parts of the country.

Insurance companies can decide that a plan will be available to everyone with Medicare in a particular state or only in certain counties. Insurance companies may also offer more than one plan in an area, with different benefits and costs. Each year, insurance companies offering Medicare SNPs can decide to join or leave Medicare.

Is Medicare Advantage Plan for hospital and medical coverage right for you:

- Most Medicare Advantage Plans cover costs and services not covered by Original Medicare.

- Medicare Advantage Plans may have lower deductibles & co-payments than Original Medicare.

- Medicare Advantage Plans usually have low premiums.

- No health question asked. All Medicare beneficiaries, including people on Medicare due to a disability, are guaranteed acceptance regardless of health conditions (except End Stage Renal Disease).

- Special plans with lower or no out-of-pocket costs may be available for “Dual Eligibles” — people enrolled in both Medicare & AHCCCS.

When choosing a Medicare advantage plan there are a number of benefits to consider. Here at the Marsh Assurance Group we will guide and advise you in comparing these private companies and products. Realizing what benefits are most important to you and selecting plans that check off the most criteria boxes along the way. Never any cost nor obligation for our education and assistance! Click here to get more information.

Understand that the plans are government subsidized and may change each year which is why it is so important to contact us at first sowe can revisit each individual situation during the Annual Election Period (AEP). Here are a few examples of things that may change:

- Plan and Individual formularies

- Dr's and Hospitals

- Co-pays and deductibles

- Maximum's Out-of-Pocket Expense